Introduction:

Purchasing a home is a significant milestone for individuals and families, often representing a substantial investment of time, effort, and finances. During the homebuying process, one essential component that buyers should not overlook is obtaining a title policy. A title policy serves as a vital protection mechanism for homeowners, offering security and peace of mind regarding the ownership and legal status of the property. This article aims to outline the importance of a title policy when purchasing a home, highlighting its role in identifying and resolving potential title issues, mitigating risks, and ensuring a smooth and secure transfer of property rights.

Defining Title Policy:

A title policy is a type of insurance that safeguards homeowners and lenders against potential financial losses resulting from defects or issues with the property’s title. It is typically issued by a title insurance company after conducting a comprehensive examination of public records related to the property’s history, ownership, liens, and encumbrances. Unlike other types of insurance policies that protect against future events, a title policy insures against past events that could impact the property’s ownership.

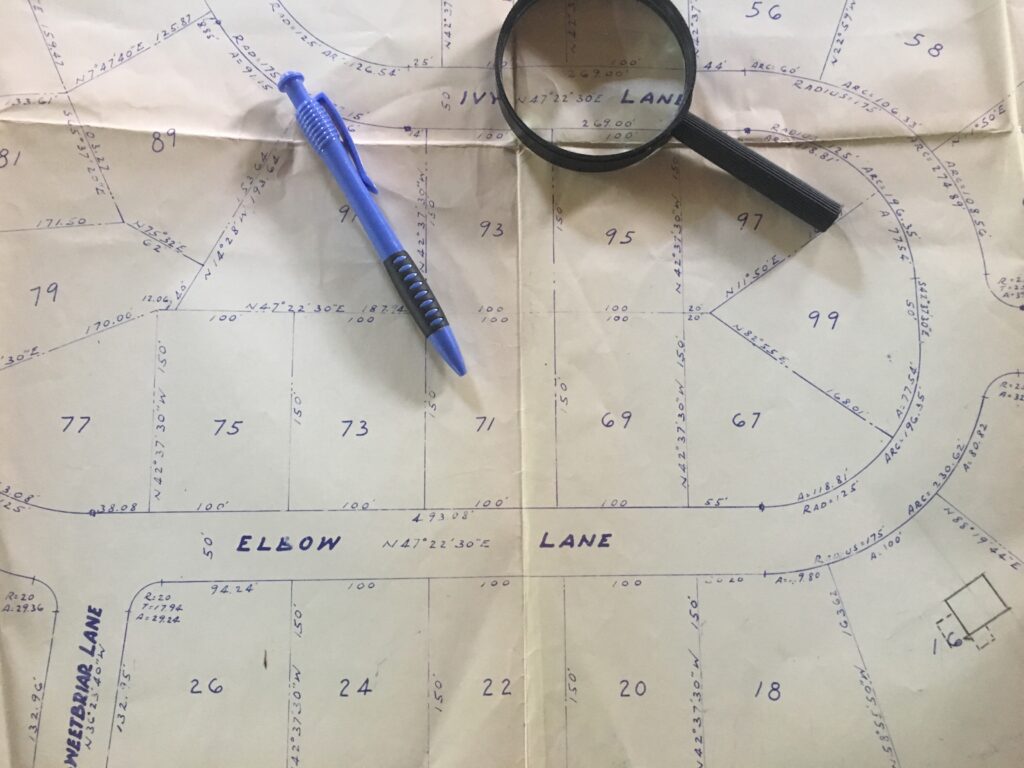

Identifying Title Issues:

Obtaining a title policy is crucial as it helps identify potential title issues that may exist with the property. These issues can include previous liens, judgments, unpaid taxes, undisclosed heirs, errors in public records, illegal deeds, or fraud. By thoroughly examining the property’s title history, a title insurance company can uncover these issues and provide the necessary information to address them before the property is transferred to the new owner.

Resolving Title Issues:

In the event that a title issue arises, a title policy offers a layer of protection to homeowners. If a covered title defect or claim is discovered after the purchase, the title insurance company will work to resolve the issue or compensate the homeowner for any losses incurred, up to the policy’s coverage limit. This protection can be invaluable, as addressing and resolving title issues without insurance coverage can be costly, time-consuming, and potentially result in the loss of homeownership rights.

Mitigating Risks:

A title policy serves as an effective risk mitigation tool for homebuyers. By purchasing a title policy, buyers can transfer the risk of potential title defects to the insurance company. This means that if an unforeseen title issue arises in the future, the homeowner is protected financially, and the insurance company will bear the responsibility for resolving the issue. This mitigates the risk of significant financial loss for homeowners and provides them with the confidence and security necessary to proceed with the purchase.

Ensuring a Smooth and Secure Transfer of Property Rights:

Acquiring a title policy is an integral part of the homebuying process as it ensures a smooth and secure transfer of property rights. By conducting a comprehensive title search, the title insurance company verifies the ownership and legal status of the property, confirming that the seller has the legal authority to transfer ownership to the buyer. This step helps prevent potential ownership disputes, fraudulent transactions, or competing claims that could jeopardize the buyer’s rights to the property. Although not required by New Jersey law, title insurance is always recommended. Further, if you are a buyer and are obtaining a mortgage, your lender will require that you obtain title insurance in order to close. Your policy will protect not only you, the Buyer, but also your mortgage lender.

Conclusion:

In conclusion, obtaining a title policy is of paramount importance when purchasing a home. It provides homeowners with valuable protection against potential title defects, helps identify and resolve title issues, mitigates risks, and ensures a secure transfer of property rights. By investing in a title policy, buyers can safeguard their homeownership, enjoy peace of mind, and embark on their homeownership journey with confidence.

IMPORTANT NOTICE

The information provided in the articles on our site is solely a public resource of general New Jersey legal information. It is intended, but not promised or guaranteed to be correct, complete, or up to date. This information is not intended to be a source of legal advice, nor is it suggested that you use it as a replacement for competent legal council. For Legal Services, call us at (732) 830-6464 or email our office.